According to all forecasts, COVID19’s economic impacts will be large and long-lasting. At the heart of these changes will be citizens in their capacity as consumers. Consumers are the very basis of every economy and every market, with businesses relying on them to operate, and governments and organisations relying on them to decide about public finances. In the end, all macroeconomic forecasts are based on the condition which consumers find themselves in, which in turn shape living conditions in a recurring cycle.

The experience of COVID19, even if a medicine and vaccine are finally found, has brought about two basic -and probably long-term, if not permanent- changes in the concept of consumer.

The first obvious and expected change relates to the financial situation of each and every consumer or each and every household. The immediate change, possibly over a short-term horizon of 12-36 months, will be the difficulty in maintaining annual income levels. The majority of sectors of the economy will have experienced a significant drop in turnover resulting in a decrease in salaries and an increase in dismissals. Businesses which engage in B2B sales will also have the indirect negative experience of a drop in turnover since their customers are consumer-focused. The same applies to the scientific community and freelance professionals. Even those businesses which have not suffered loss, or those on the contrary which have been positively affected, will face unprecedented operating conditions. Initially, sufficient funds will be needed to redesign their operating model, so their profits will be consumed quite quickly, and then the sense of self-preservation will kick in and the idea of retaining profits for the difficult days that lie ahead will come to prevail. It is important to point out that banks at global level will be unable to cover the loss of income for consumers and businesses via loans either because the necessary funds are not available or because they in turn will take an even more conservative stance and will be reluctant to provide loans. The same applies to governments. The money available to them comes from taxing citizens and it is not unlimited. Even the ‘solution’ of printing brand new money will only generate short-term results leading to inflationary problems in the near future.

The second, perhaps not so visible change, relates to consumer behaviour worldwide. This change will be long-term, lasting at least for the next five years, and will affect both how and what we consume. It is certain that consumers will not visit shops, department stores and shopping centres as frequently or as easily as before, but will prefer to make purchases via company e-shops. If we add to this the fact that many consumers have now become familiar with shopping online, albeit out of necessity due to the pandemic, then it’s clear that the segment of the public shopping online has grown significantly and is here to stay. These points relate to the change in how things are done. However, there is also a change in the type of consumption or consumer preferences. Consumers will now rank their needs differently. For example, entertainment in mass meeting places (ranging from restaurants to concert venues) will not rank as high as a necessity among consumer preferences, with the result that this part of their available income will be directed to entertainment at home and/or online applications. Travel abroad will become very difficult and will result in a preference for remote visits to museums, archaeological sites or other sites of special interest via special web applications. On the contrary, consumer preferences for long-lasting products for their day-to-day lives at home such as white goods (washing machines, refrigerators, cookers, freezers), high-tech equipment (tablets, laptops, televisions, gaming platforms), furniture and decorative items will rise in terms of consumer needs and preferences, resulting in a significant share of their disposable income being absorbed there.

In light of the above, one can easily formulate the following questions.

Consumer income will be negatively impacted and demand for consumption for necessary or “new” items and services will remain inelastic. How can merchants or manufacturers of the product or service be paid?

Merchants and manufacturers of products and services should continue to be able to sell. How can their products be attractive and how can they make it easier for consumers to buy on credit, but with the certainty that they will actually receive the sale price?

Direct answers to these questions and others related to them can, in my opinion, be found in an “old” form of currency, but luckily there will be support from new technologies such as predictive big data analytics, AI and machine learning.

The “old” currency is the purchase of goods, products and services on favourable payment terms, through instalments. It is clear that the answer to the questions from the consumer “where will I find the money to buy things when my income has shrunk” and from the seller “how will I sell so I don’t have to close down my store?” will come by keeping some sort of “credit account”; from a procedure for reliably placing repayment of the total purchase price in an instalment plan.

This time, however, the “credit account” won’t be a horizontal solution that’s the same for everyone. Thankfully. Technology can safely predict both consumers’ wants and needs and their ability to repay and how they can do so, so that we don’t end up with a large community of transacting parties who are unable to service their debts.

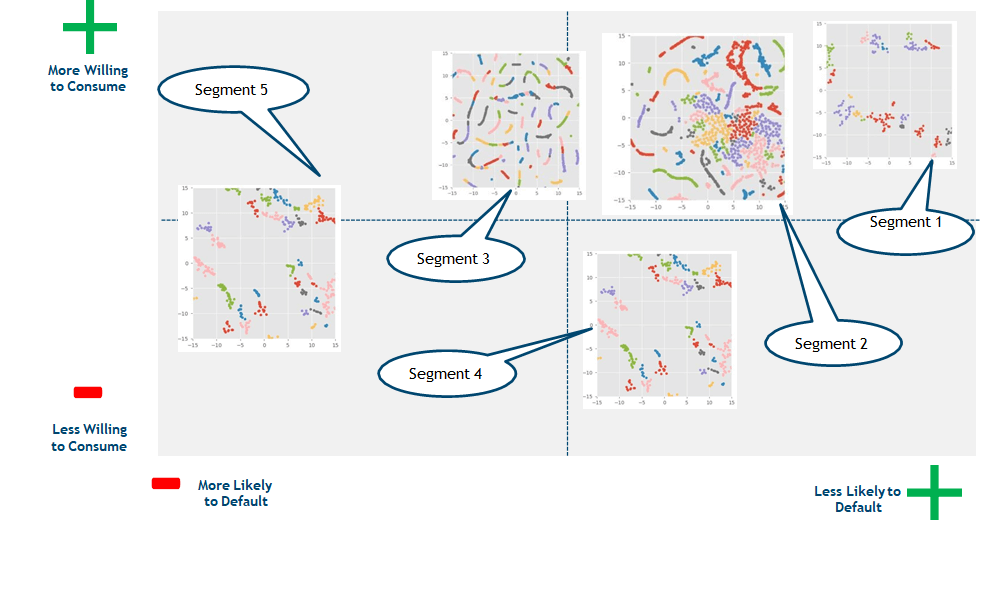

Predictive big data analytics can now reliably determine where each consumer profile falls into the diagram below:

To ensure this “new” currency operates in a balanced, sustainable manner, the following conditions must be met:

- Using technology, the instalment or repayment plan can and must be tailored to the individual, based on the consumer’s actual ability to pay. This can be determined based on what the consumer has to say but also by matching their profile to that of other similar consumers by studying their actual reactions to how their payments are ranked. For example, a freelance professional or a seasonal employee has different priorities than a public sector employee, due to the manner and frequency at which income is generated and taxed. What suits one is to pay zero in periods when no income is generated but proportionally higher instalments in other months, whereas what suits the other is to pay a fixed percentage based on net monthly income.

- The plan must be dynamic, and there must be constant two-way communication so that consumers can gain trust and feel secure in the sense that if something does go wrong they can immediately find a way to adjust their repayment plan without fearing that the product will be taken away from them. Likewise, if things go well, it must be possible to repay more quickly without penalties so as to free up the credit limit to enable new purchases to be made.

- No bank or credit institution should intervene here. No intermediary is needed since that would raise the cost of the plan and in effect calculation of the risk which each seller is or is not willing to assume will be done by the relevant technology platforms. In fact, both the consumer’s application and the seller’s response are provided online in real-time.

- Some form of a consumer e-wallet needs to be created which will be defined, based on technology, as an amount in euro which will signal (a) the consumer’s desire/need to buy things and (b) the likelihood of paying that amount in an instalment plan which, as we said, should be personalised to the consumer. In other words, based on his profile, which is stored in the e-wallet, consumer A will have an amount of say € 300 which can be spent entirely on a single or multiple purchases, which can be repaid using real money on the basis of one or more instalment plans.

- A group of sellers must be initially set up at which the consumer e-wallet can be used. A good place to start would be sellers of long-life household products. In other words, white goods such as refrigerators, washing machines, or sellers of kitchen furniture and kitchen equipment or bedroom furniture, etc. International statistics have shown that the lowest levels of bad debt come from financing purchases on credit for such products; consumers consider them to be essentials once they’ve decided to purchase them and fear these products being taken from them.

- e-wallets should not be some placebo for money like ‘consumer’ loans used to be (and probably still are). The value of the e-wallet for each of us is that we can only purchase products from sellers who are included in the e-wallet scheme and can’t just generally spend money, as is the logic with credit cards, for example.

Many will have questions. Since no bank is involved, how will the entire transaction cycle be financed? There are basically two parts to the answer. Firstly, the purchase-payment cycle is financed by sellers’ own suppliers. In other words, the manufacturers of those products will seek to secure their own receivables depending on the type of product, the seller, volume of sales, and market conditions. Especially in the post-COVID19 era it won’t be unusual for this to happen; in fact, one can say it is already happening, especially for manufacturers in China. Secondly, there will be specialised financial instruments as well as organisations which will purchase from the sellers and discount this mass of purchases made using e-wallets. It would be akin to receiving a micro-loan, a micro-credit, before it went into default. A third part of the response could be a more institutional approach where EU organisations such as the EBRD could finance this “new” currency as a form of support for consumers and sellers, if -of course- it starts to be used on a large scale.

The world we knew no longer exists in the post-COVID19 era. Consumers will suffer financially, and businesses will also suffer. However, needs remain, and since technology can provide a solution so we can continue to trade reliably in the future -or perhaps even better than we have traditionally done- we really ought not to be afraid.

The Opinion was published in the Greek financial information portal Capital.gr