Since the start of the energy crisis with spiralling electricity and natural gas prices, both consumers and energy providers have been feeling stressed about monthly bill payments and collections respectively.

Debt settlement plan are a standard tool employed by energy providers/ creditors, offered to customers unable to pay their bills and debts in general in good time. However, are debt repayment plans really a good idea? The results of a relevant WEMETRIX sample survey, conducted between September and December 2021, on consumers (households and small and medium-sized enterprises) don’t reveal an encouraging picture when it comes to such plans.

According to the survey, three out of four consumers stated that they had not fully paid off their debts under the repayment plan they had in place; and that was regardless of the amount due. Unsustainability is even higher in cases of debt repayment plans involving numerous instalments, which is a rather impressive finding especially when considering that one would have expected the opposite to be true. Of course, there tends to be a higher number of instalments when the amount to be repaid is higher (a practice which is wrong). In other words, the more you owe the more instalments you get. That’s totally wrong! Such practice sends out the wrong signal as it encourages non-payment while being unfair to those in real need of debt repayment plans.

Across-the-board repayment schemes, even with sliding scale payments, offered indiscriminately to all debtors have never led to debts being fully repaid in any market on the planet. Likewise, no debt has ever been paid off unless both parties are in a financially viable situation. This is a lesson well learnt from uncollectible tax debts and non-performing loans.

Artificial Intelligence offers consumers some light at the end of the tunnel, providing a way for them to be able to pay their bills and for energy providers to collect the respective payments by utilizing special algorithms.

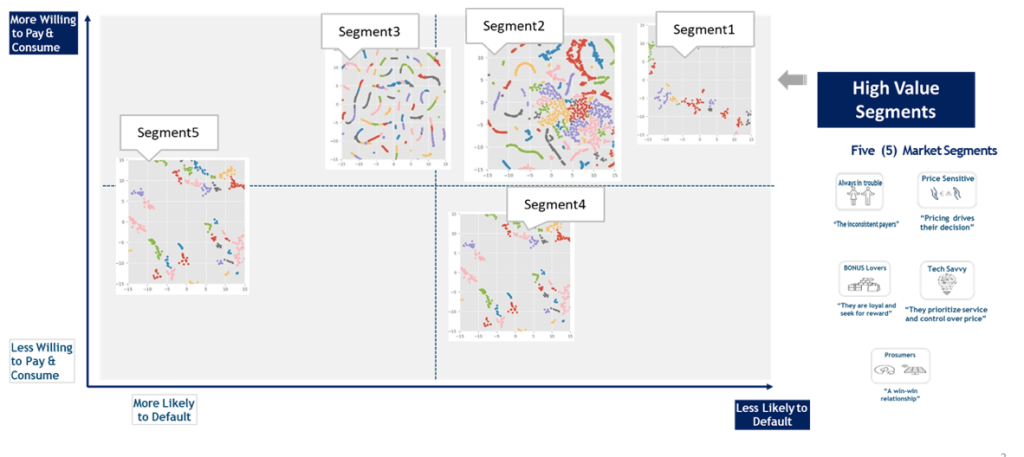

The following diagram shows us an example of how Artificial Intelligence and Machine Learning algorithms could select from millions of primary data points those “consumer groups” which do not fall into traditional categories, e.g., low – medium – high voltage or B2B/B2C consumers, but nonetheless have common behaviours and take decisions based on their lifestyle and stage in their life.

Algorithms keep track of consumption and payment behaviours through energy providers’ systems, integrate profile characteristics as stated by the consumers themselves, and compare aggregated data attributes from 20,000 micro-regions inside Greece in order to categorise consumers into appropriate profiles. Significantly, there are 74 profiles in Greece, with identical or similar (very slightly different) electricity and natural gas consumption behaviours.

Do all low voltage consumers with a € 300 debt behave in the same way? Consider for instance a recently divorced consumer who has a € 300 debt but also has to pay spousal maintenance, and a single consumer with the same amount of debt who just got a pay raise.

One might reasonably wonder how energy providers could possibly gather all this information about thousands of customers and whether they are actually allowed to do so. Technology holds the answers to these questions. But let’s first clarify whether one is allowed to gather such information, especially without breaching the General Data Protection Regulation (GDPR). Artificial Intelligence platforms come with the option to interact with consumers allowing them to consent to the sharing of some profile data without that data being saved forever. Imagine a borrower standing at a bank counter or desk to request a loan repayment plan. Now, try to picture all data being processed digitally, in a fast and objective way in order to customize that repayment plan. By performing continuous and repetitive calculations, Artificial Iintelligence algorithms generate very precise results both in terms of validly considering consumers’ need for a loan repayment plan and determining what the repayment plan should look like based on each consumer’s profile.

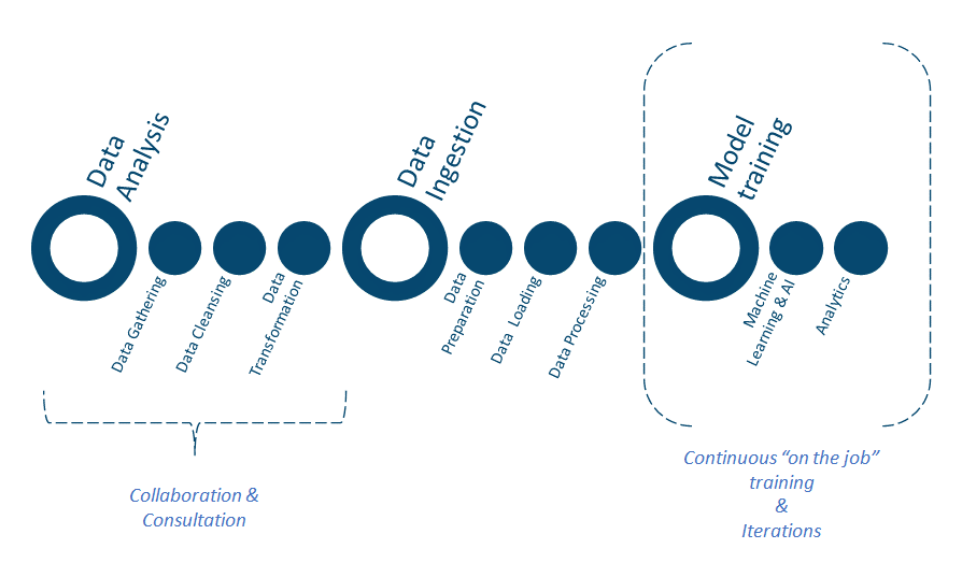

The following diagram offers a top level description of the iterative operations performed by Artificial Intelligence algorithms, readjusting both their parameters and variables; an approach which differs from standard statistics and econometric data analysis.

Their predictive power based on that data at that point can be as high as 88% for a 3-month period prior to the consumer becoming unable to pay soaring electricity bills.

The use of such applications allows energy providers to achieve their main goal which is constant communication with their customers in order to avoid a hostile atmosphere on both sides, which was what happened in the banking sector. Moreover, continuous cash flows are bolstered. As shown by WEMETRIX’s survey results customers want to pay, but want to do so based on their own profile and circumstances. Such applications are now collectively known as Customer Value Management (CVM) tools, since all communications between energy providers and customers are now related to “empathy”. Customer Value is confirmed by matching purchases to payments. CVM solutions for debt repayments often lead to important cost decreases for energy providers, since they no longer need to involve debt collection agencies and law firms. They also increase the cross-selling (X-Sell) of other services and products (such as green appliances) to consumers who need to lower the cost of the energy they consume.