Will the sector be able to cope without problems in 2021 given the lack of liquidity? Will companies be able to retain their truly valuable customers? Will they be able to enter into viable, personalised debt settlement arrangements or will they face the future of the banking sector with its non-performing loans running into the many billions of euro?

It is clear that the pandemic and lockdown were bound to leave their mark on Greece’s energy sector. As in many other sectors of the Greek economy, this impact primarily manifests in relation to payments – collections.

As one might expect, reductions in company liquidity (which over the last 12 months has come about from imposed suspensions of operations or from the major drop in turnover) has caused delays in energy bills being paid. Together with payrolling costs and liabilities to the public sector, energy is the main cost for many companies regardless of their size or the sector in which they operate.

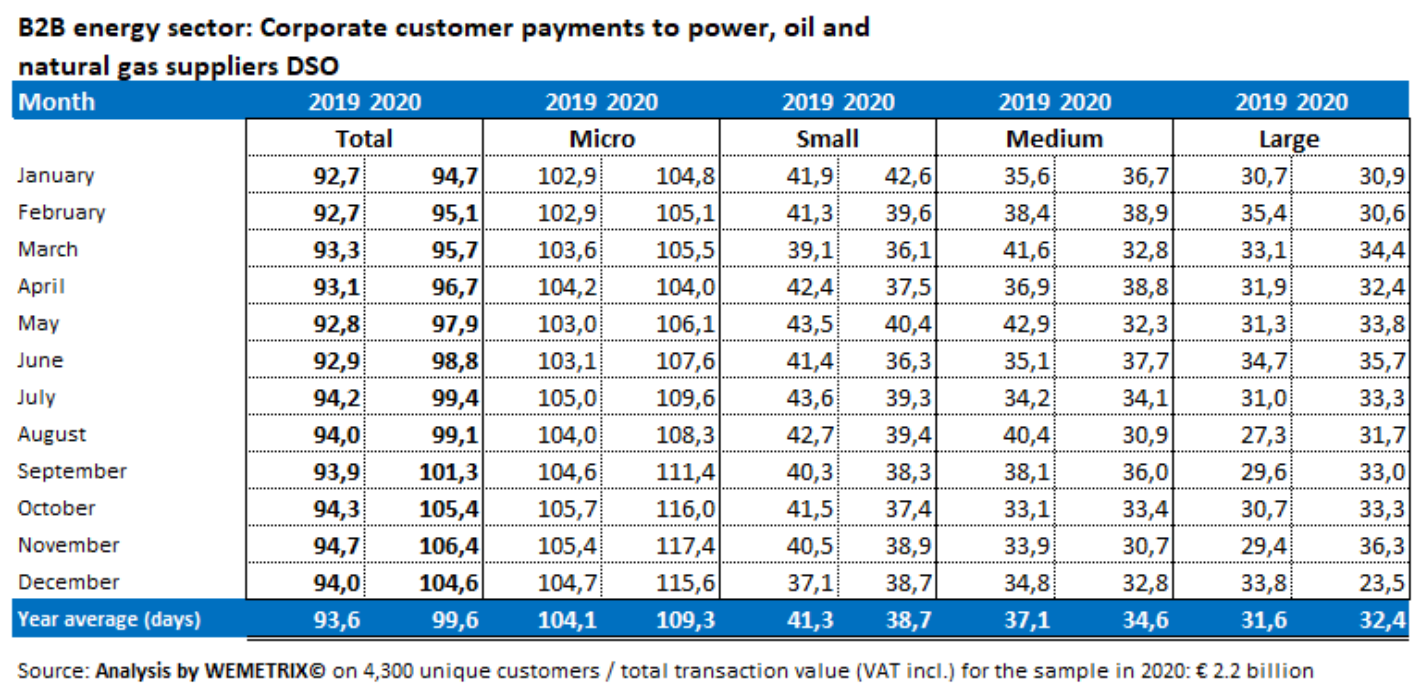

The table below shows in summary form the results of the analysis carried out by WEMETRIX©, a company in the INTRASOFT INTERNATIONAL Group. We used machine learning algorithms to measure energy bill payment days per month and per company size to calculate transactional credit risk and precisely work out the provisions companies need to form for possible payment arrears or final defaults in payments.

More specifically, over a period of 24 months from January 2019 to December 2020 we took measurements from 4,300 customers of power supply companies, on a volume of transactions worth € 2.2 billion. The measurement period includes the seasonality normally seen in the sector, but above all includes the lockdown periods.

Those 4,300 were business -i.e. non-residential- customers. In other words, this very large sample included the offices of scientists, freelance professionals, neighbourhood shops as well as large industries. They were divided up by size based on the value of consumption for each energy supplier and not their legal form and financials. This segregation is of particular importance because it captures the actual size of the customer to the supplier and not how it is categorised in legal or accounting terms. That would not have been possible were it not for the machine learning algorithms.

The first conclusion is that the average number of days within which energy bills are paid has risen from 93.5 days to 99.6 days in 2020. An increase in the Days Sales Outstanding (DSO) index by one week to ten days approximately may not appear to be a major change, but in fact it translates into a delay in collecting 2.7% (10/365) of annual sales VAT incl. As a percentage, that figure can then be directly compared to the net profits of a business. Practically speaking, a power supply company typically has a pre-tax profit of around 3%. Combining that information with the aforementioned delay means that the majority of that profitability will not actually have been collected during the course of the year; add to that the usual, agreed credit terms offered to customers. In other words, this delay will eat up power suppliers’ entire profit.

In addition, every undertaking in the power supply sector will now be required to meet additional capital needs either using fresh money (debt or equity) or generating money by rolling over such arrears to its suppliers, which is clearly subject to restrictions such as the supplier’s negotiating power, dependence on foreign suppliers, high borrowing costs, etc.

The second important conclusion, among others, is that small and medium-sized enterprises have tried and managed to reduce their payment days by primarily exploiting the credit and commercial policies of power suppliers, while micro enterprises and large ones showed they were unable to cope and that raised the average. However, the problem with the rise in arrears as a phenomenon among customers at each end of the customer allocation spectrum is greater because, of necessity, it will, to a large degree, affect the entire sample quite soon.

Will the sector be able to cope without problems in 2021 given the lack of liquidity? Will companies be able to retain their truly valuable customers? Will they be able to enter into viable, personalised debt settlement arrangements or will they face the future of the banking sector with its non-performing loans running into the many billions of euro?

Technology can help but the will and determination to implement a new framework for how power suppliers and corporate customers, above all, transact with each other is needed. And that will and determination needs to come from the power suppliers.